New Thoughts on How to Build Wealth and Tax Efficient Cashflow

- Brendan Greenwood

- Jan 20, 2021

- 6 min read

Updated: Jan 22, 2021

Quarterly | January 20, 2021 | Brendan Greenwood CIM, QAFP, B.Comm

An opportunity to buy income generating assets at a discounted price

The time I’ve spent in recent months at my office in the financial district has been lonely. The streets are empty and the surrounding businesses that relied on traffic from office tenants are closed or suffering. I’ve never seen so many office lights off when I look at the surrounding skyscrapers. At times it feels a bit like a post apocalyptic world where only a few people have survived some catastrophic event.

The work from home phenomenon brought on by the pandemic has meant that many people can work from anywhere. And people have taken advantage of this by moving out of cities to get more living space at an affordable price. Rent for urban residential units and in some cases office and retail space have dropped substantially. This mass exodus from urban centres brought on by the pandemic has created a lot of concern amongst REIT investors and triggered a large sell off in REITs that hold a lot of urban real-estate. Some REITs are still trading at prices far below their pre-pandemic values, in some cases almost as much as 40% lower.

Investors have a unique opportunity to indirectly own real estate assets with yields of more than 5% without the headaches that come with purchasing and maintaining a rental property. You can still buy some of these REITs at prices not seen in 20 years, with the exception of the temporary drop in prices during the financial crisis. The entry points today should provide capital appreciation over the longer-term, something traditionally not seen in the REIT space where assets are purchased primarily for the income they generate.

There are two key forces that will help ensure empty buildings in the downtown core will be fully used again even if some end up being re-purposed.

1) Mass Vaccinations – This will take time, but once the majority of the population is vaccinated urban centres will come back to life as peoples’ activity normalizes.

2) Need for Social Connections – Yes, some things can be done over computer screens more efficiently, but technology will never totally replace the need for in person social connection. Vibrant urban centres help facilitate this human interaction that is necessary for our emotional and physical well-being.

Careful analysis should be undertaken in considering any REIT investment and the businesses the REIT is exposed too. With sound advice, this area of the market is worth exploring for those seeking higher income than bonds yields provide with the potential for capital appreciation as the impact of the pandemic winds down and downtown urban centres come back to life.

Are current stock prices sustainable or is the stock market primed for a correction?

The Nasdaq led the main North American stock market indexes higher with a return of over 40% in 2020. Some analysts have claimed the stock market is too expensive to justify current valuations.

Fiscal policy in Canada and the US ran big deficits and gave people a lot of money to spend without many places to spend it. This resulted in record savings and demand for investment opportunities driving markets well beyond pre-pandemic highs. A key question is how high is too high? If we look under the hood, interest rates continue to remain at historical lows and there continues to be unprecedented stimulus providing excess liquidity to the stock market.

The cyclically adjusted price earnings ratio (CAPE ratio) is a key valuation metric in determining whether assets are overvalued. When we look at the CAPE ratio of the S&P 500 at 33, there are only two times it has been as high or higher, just before the 1929 crash and burst of the dot com bubble in 2000. The Cape ratio of the S&P 500 in 1929 was 31 and right before the dot com bubble burst it was 43. A current S&P 500 CAPE measure of 33 suggests caution is warranted, however this valuation has to be viewed in the light of today’s low bond yields.

Risk free US treasury bills in the late 90s generated real returns above 4%. Today 1 and 2 year US treasury yields are near zero. This means when compared to a fixed income alternative, a CAPE ratio of 33 with an implied return of about 3% on earnings looks a lot better than zero and can be expected to rise higher in the current very low interest rate environment. It is likely interest rates will remain low as the economy wrestles to recover from the impact of the global pandemic. However, as the economic recovery takes hold both inflation and interest rates should be watched closely because of the important support role they play with current market pricing.

How to make your non-registered savings more tax efficient if you need to regularly draw funds to support your lifestyle in retirement

For anyone looking for tax-efficient cash flow you should explore a return of capital strategy (sometimes referred to as T-SWP).

The strategy can be deployed with as little as $100,000. The analysis below completed by Fidelity Investments shows how attractive the potential strategy can be for some investors. The example uses a $1 million dollar investment portfolio over a 7 year period. The average annual cashflow drawn was approximately $75,000 a year (7.5% of the original principal amount invested). Approximately 75% of this distributed cash flow was not taxable to the individual and the closing balance of the account was approximately $2.5 million.

It’s important to note that past performance is not a predictor of future performance and market conditions are constantly changing, so the implementation of any new strategy like this should carefully be reviewed with your advisor.

Looking for a new investment opportunity? Consider purchasing shares in famous works of art

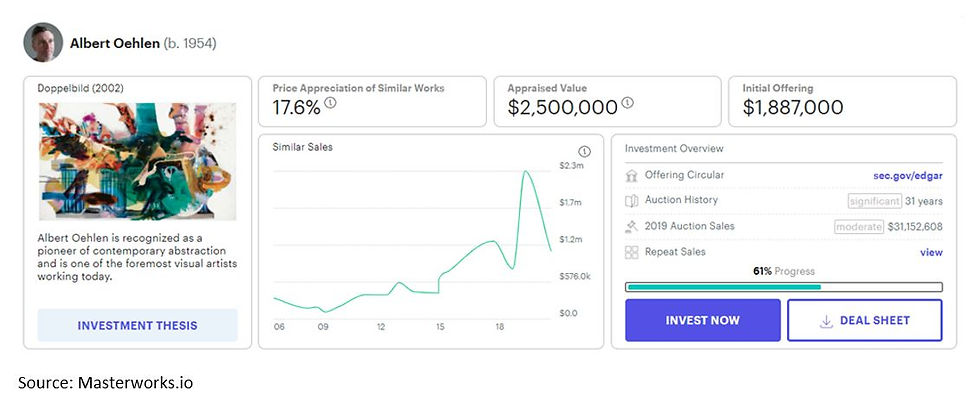

The ability to invest in art created by famous artists like Andy Warhol and Banksy has been democratized. You no longer need to be part of the ultra rich to participate in this space. You can now buy and sell shares in various artwork through Masterworks online investment platform which has securitized fine art and turned it into another asset class that the average retail investor can take advantage of.

According to Citi Private Bank research, paintings bought for more than US $500,000 to US $1 million tended to preform better than lower priced works. Masterworks.io indices reflect auction sales data utilizing a price weighted approach similar to those of market cap weighted indices like the S&P 500. Contemporary art appreciated in value on average 11.5% annually since 1985 Citi Private Bank research reported.

Fine art may become a more attractive alternative asset class to diversify a portfolio in years to come for a couple reasons:

1. Low interest rates force investors to become more creative in looking for ways to protect and grow asset value.

2. There is a finite supply of fine art if the artist has passed away.

3. Art has the potential to provide added portfolio diversification because there currently is very little direct correlation with other more traditional investment options.

Brendan Greenwood is an Investment Advisor with Worldsource Securities focused on personal pension strategies and leveraging technology to provide progressive institutional style investment solutions for professionals, incorporated individuals, business owners, retirees and their families.

For other articles authored by Brendan Greenwood on issues impacting business owners and individual investors see https://www.greenwoodwealth.co/blog.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the fund facts before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

This material has been prepared for informational purposes only and should not be considered personal investment advice or solicitation to buy or sell any securities. As well, it is not intended to provide, and should not be relied on for, tax, legal or accounting advice. It may include information concerning financial markets as at particular point in time and is subject to change without notice. Every effort has been made to compile it from reliable sources, however, no warranty can be made as to its accuracy or completeness. Investors should seek appropriate professional advice before acting on any of the information here. The views expressed here are those of the authors and writers only and not necessarily those of Worldsource Securities Inc., its employees or affiliates. There may also be projections or other "forward-looking statements." There is significant risk that forward looking statements will not prove to be accurate and actual results, performance or achievements could differ materially from any future results, performance or achievements that may be expressed or implied by such forward-looking statements and you will not unduly rely on such forward-looking statements. Before acting on any of the information provided, please contact your advisor for individual financial advice based on your personal circumstances. Worldsource Securities Inc., is the sponsoring investment dealer and the member of Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

Comments